-

Finance

You Should Love The 529 Plan More After OBBBA Passed

As soon as both my children were born in 2017 and 2019, I superfunded their 529 plans equal to the…

Read More » -

Finance

How Cultural Differences Can Hurt Your Chances In The Workplace

When I lived overseas, one of the most celebrated aspects of my international schools was cultural diversity. At the International…

Read More » -

The Cost To Remodel A Rundown Two-Bedroom In-Law Unit

After remodeling a fixer I bought in 2019 between 2019–2022, I swore I would never take on another remodeling project…

Read More » -

Finance

The Healing Power of Returning to Your Childhood Home

One of the main reasons I refused to spend a small fortune renting a vacation property in Honolulu was because…

Read More » -

Finance

What It Takes to Feel Wealthy Today Is Less Than Before

How much money do you need to feel financially comfortable or wealthy? The answer depends on where you live, your…

Read More » -

Finance

The Richest People Are Not Index Fund Fanatics – Why Are You?

I love index funds and ETFs for their low-cost nature and simplicity of ownership. However, if you want to build…

Read More » -

Finance

The Step-Up In Cost Basis And Its Relation To The Estate Tax Threshold

Imagine spending your life building wealth, investing in real estate, stocks, or your business, with the hope of leaving a…

Read More » -

In Defense Of Owning A Big Beautiful Home Over A Small One

The value of owning a big, beautiful home is underappreciated. Somewhere along the way, society began favoring minimalism and smaller…

Read More » -

Finance

Low US Household Leverage Bodes Well For The Economy

One of the things that gives me great comfort about the health of the U.S. economy is our historically low household leverage.…

Read More » -

Finance

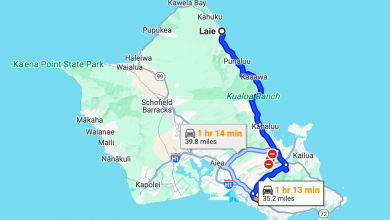

The Cost of Supercommuting: Way More Than Just Gas Money

A typical supercommuter spends 60–90 minutes or more one way commuting to work or school. As the cost of living continues to…

Read More »