Novo Business Checking Review

Novo Business Checking

Product Name: Novo

Product Description: Novo Business Checking has no fees, no minimum balance requirements, and lots of integrations to make life easier.

Brand: Novo

Summary

The Novo Business Checking account has several features that make life a little easier for small business owners. You can send unlimited free invoices right from your account, and they integrate with several popular business tools that can make running your business smoother and easier. There is no monthly fee or minimum balance requirements, but you can’t deposit cash.

Pros

- No monthly fees or balance requirements

- Get Stripe payments faster with Novo Boost

- Attractive list of integrations

- Free invoicing and other reporting tools

Cons

- Limited customer service options

- Cannot deposit cash

- Limited wire transfer capabilities

The Novo Business Checking is an online-only checking account with an attractive fee schedule and many tools and integrations. You can send free invoices, earmark money for taxes, and integrate your account with many of the tools you already use.

The main drawbacks are that you can’t easily deposit cash, and there are no physical locations for in-person banking. Also, customer service is only available through chat or email.

At a Glance

- $0 monthly fees and no minimum balance

- Send free invoices

- Auto categorization of transactions

- Get paid faster with Stripe

- Easily integrates with Etsy, eBay, Stripe, Gusto, and more

- Can’t deposit cash

- No physical branches or phone support

Who Should Use Novo Business Checking?

Novo Business Checking can be a great option for small business owners who don’t deal with a lot of cash and are comfortable banking through an app.

Its fee-free checking offers many convenient features for operating your business online. For example, its integrations are easy to use with other programs such as Quickbooks, Stripe, and PayPal. You can also send invoices for quick customer payments and set money aside for taxes as revenue comes in.

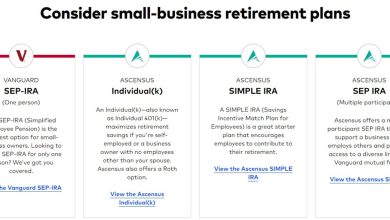

Novo Business Checking Alternatives

|

|||

| Monthly Fee | $0 | $0 | $15 (waivable) |

| Minimimum Balance | $0 | $0 | $0 |

| In-Person Banking | No | No | Yes |

| Learn More | Learn More | Learn More |

Table of Contents

What Is Novo Business Banking?

Founded in 2018, Novo is a fintech company that offers a business banking account. While it is not a bank, Novo partners with Middlesex Federal Savings Bank, meaning all Novo funds are FDIC-insured through Middlesex Federal Savings Bank.

Novo Business Checking Account Basics

There’s a good reason we include Novo on our list of best business checking accounts. Novo is competitive when it comes to basic banking features.

- $0 minimum balance requirement

- $0 minimum opening deposit requirement

- $0 monthly fees

- $0 monthly ATM fees, reimbursed up to $7 per month for outside ATM fees

- Unlimited transactions

You can deposit money into your Novo account by making a transfer from another account, creating a wire transfer, or using mobile deposit to deposit a check.

Note that Novo does not accept cash deposits. If you have cash to deposit, you can use it to purchase a money order, which you can then deposit into your Novo account via mobile deposit.

Novo Business Checking Account Features

Novo has several features that make business banking convenient. Here are the details of some of Novo’s most attractive banking features.

Free Invoicing

Novo offers unlimited free invoicing with your Novo business checking account. You can send an invoice right from the Novo app, and customers can pay using integrations such as Stripe or PayPal.

While Novo doesn’t charge subscription or per-invoice fees when you send an invoice through the Novo app, note that Novo’s partners may charge you a fee. For example, Stripe will charge a fee to run the credit card.

The invoices are customizable so that you can include your branding.

Novo Reserves

Novo offers a feature called Novo Reserves. With Novo Reserves, you can designate a percentage of each deposit to be set aside into your specified Reserves accounts.

You can have up to 20 Reserves accounts for designated savings goals such as paying taxes, emergency funds and more.

Reserves funds are not held in separate accounts. The funds will appear in your Novo banking account; however, you’ll be able to see that they are designated toward other expenses.

Novo AI Insights

Novo’s smart insights feature automatically categorizes your business banking transactions to help make tax time easier.

You can also find payroll reports and payroll tax document tools on the web application.

Novo Boost

If you’re a Stripe user, you can sign up for Novo Boost and get your Stripe payments up to two days faster.

There’s no charge to use Novo Boost. Conversely, Novo also has a feature for sending ACH payments on the same day, called Express ACH. This option costs 1.5% of the payment with a minimum payment of $20.

Novo Funding

Novo also offers Novo Funding. Novo Funding is a merchant cash advance system that advances you money in the form of a loan.

The amount you’re eligible for, as well as the interest rate and repayment terms, are based on your business’s history, credit score and other factors.

There is no personal guarantee required to use Novo Funding, and there are no penalties for paying the cash advance off early.

Novo Integrations

Novo has a healthy list of integrations to help you manage all aspects of your business. Being able to integrate your bank accounts with the services you use to run your business can make bookkeeping easier and faster. Here are some key partners you can integrate into your Novo business checking account.

Stripe

If you integrate Stripe with your Novo account, you’ll be able to process your first $5,000 in payments for free, which is a $150 savings.

Once integrated, you’ll see your Stripe information right in the Novo app, including any incoming payments. You can also get Novo Boost for free and get your payments from Stripe in hours instead of days

Quickbooks and Xero

Novo connects seamlessly to Quickbooks, making your bookkeeping smooth, quick, and less error-prone.

With Quickbooks, you can export your profit and loss data directly to the Novo app allowing you to see exactly where you stand at all times.

If you don’t have Quickbooks yet, you can get a 30% discount on the first six months of Quickbooks with your Novo account.

Square

If you use Square for payment processing, you can integrate it with your Novo business checking account. When you do, you’ll be able to see data such as your sales, taxes, and discounts in the Novo app.

You’ll also be able to see your upcoming payouts, so you know exactly what’s coming and when.

Shopify, eBay, and Etsy

If you sell physical products, you can connect your Shopify, eBay, and Etsy accounts to Novo. This will allow you to track your revenue on these platforms and see any pending payments, helping you keep an eye on your sales and cash flow.

Wise

If you have international contractors, you may use Wise to pay them. If so, you can integrate it with your Novo Business Checking Account and send Wise payments right from your account.

Gusto

If you use Gusto to do your payroll, you can see your next payroll date and amount inside your Novo account. This will help ensure you never miss a payroll and always have the funds available.

Novo will even look ahead and let you know what your balance is expected to be on payday, allowing you to time any upcoming business expenses with your next payroll.

Slack

The Slack integration allows you to better communicate with your team, or just yourself, about your business transactions.

You can set up a Slack channel and your Novo account will automatically send updates about transactions.

Zapier

If you aren’t familiar with Zapier, it’s a service that allows you to connect just about any two things online and perform custom automations. For example, you could set it up to send you a text every time your employee buys gas with their business debit card.

The Zapier integration means you can set up a wide variety of automations from the activity in you checking account.

Novo Alternatives

There are plenty of business checking accounts out there, here are some alternatives to the Novo Business Checking account.

Bluevine

Bluevine is a fintech company and operates similarly to Novo. Features of Bluevine Business Checking include:

- $0 minimum monthly fee

- $0 minimum balance requirement

- Zero overdraft fees

- Fee-free in-network ATM usage

- Unlimited transactions

The biggest difference between Bluevine and Novo is that Bluevine will pay you interest on your checking balance. To earn interest, you need to spend at least $500 per month using your Bluevine debit card.

Or you need to have at least $2500 per month in customer payments, verified by check deposits, ACH deposits, or payment processing company deposits.

And like Novo Reserves, Bluevine offers sub-accounts with your checking account so you can put money aside for payroll, taxes and more.

You may prefer Bluevine if you can meet the requirements that allow you to earn interest. However, if you have a lot of out-of-network ATM usage, you might want to stick with Novo due to their up-to-$7 per month out-of-network ATM fee reimbursement.

Check out our Bluevine Business Checking review to learn more.

Axos

Axos is a bona fide bank, as compared to Novo which operates as a fintech company. The basic features of Axos’ Basic Business Checking include:

- $0 monthly fees

- $0 Minimum opening deposit

- Free in-network ATM usage

- Unlimited domestic ATM fee reimbursements

Because Axos is an actual bank, you can also open savings accounts and CDs with Axos.

If you’re searching for more of a “bank experience” for your small business, you may prefer Axos over Novo.

Axos does offer merchant services and payroll services. However, it does not offer invoicing services.

Where Axos really stands out is that it offers a Business Interest checking account that will pay interest on your checking account if you open the account with a minimum of $100 This account does charge a $10 monthly fee, but the fee is waived when you keep a $5,000 minimum daily balance.

If you like the idea of working directly with a bank, want the option to have a savings account or CDs or make regular cash deposits, you may prefer Axos.

However, Novo is a great choice if you prefer the invoicing and other tools it offers and like the idea of solely electronic banking.

Chase Business Complete Banking

Chase is the country’s largest bank, so if you are looking for in-person banking and a full array of account types and bank services, then perhaps Chase’s Business Complete Banking is for you.

It offers the Chase QuickAccept feature, which helps you to accept credit card payments almost anywhere. Chase’s QuickDeposit feature helps you to accept checks for deposit while you’re on the go. Other features for this account include:

- Unlimited electronic, ATM and debit card transactions

- $15 monthly fee (waivable)

- Fee-free cash deposits of up to $5,000 per statement cycle

- Free in-network ATM usage,

- $0 minimum opening deposit

- $0 minimum balance requirement

You can get the monthly fee for this account waived if you meet one of five criteria each statement period:

- Keep a $2,000 minimum balance

- Link to a Chase Private Client checking account

- Provide proof of military status

- $2,000 in purchases on your Chase Ink Business card

- $2,000 in deposits from ChaseQuickAccept

Chase doesn’t offer the free invoicing, Novo Reserves or other money management tools that Novo does. However, you do have the option to visit a branch location and deposit cash with Chase.

If your business makes regular cash deposits, accepts credit card payments regularly, or needs regular in-person banking help, you may want to choose Chase. However, if online banking works well for you and you make a limited number of cash deposits, Novo should do the job.

Here’s our full review of Chase Complete Banking.

FAQs

Who can open a Novo account?

You’ll need a U.S. state driver’s license, a U.S. state ID, or a current passport to open a Novo account. You’ll also need a Social Security number, a U.S. physical address and certain business documents.

Does Novo offer personal accounts?

No, Novo does not offer personal accounts.

Does Novo charge overdraft fees?

Novo does not charge overdraft fees, and the company does not offer overdraft protection. They do have policies in place to help you prevent overdrafts, such as sending low-balance alerts and paying smaller items first.

Can I get checks with my Novo account?

You can’t order checks with Novo. However, they do have an option for you to request that they send a check on your behalf. There is no charge for this service.

What are Novo’s customer service options?

You can contact Novo’s customer support through the app chat support option or by email at [email protected]. Support business hours are Monday through Friday, 9am to 6pm EST.

Other Posts You May Enjoy:

Chase Business Complete Banking Review

With a wide range of small business products and services, Chase is one of the top business banks in the U.S. But can Chase Business Complete Banking compete with lower-cost accounts offered by fintechs and online banks? Learn more.

Found Business Banking Review: A Freelancer’s Dream?

Found is a business banking fintech that offers a free business checking account with integrated tools to automate various aspects of your business, from reporting to invoicing to payments, and more. Is Found right for your business? Learn more in this Found review.

How to Pay Yourself as a Business Owner

Figuring out how to pay yourself is one of the first things you need to figure out when starting a business. But it’s a complicated matter, especially if you’ve established your business as a partnership, LLC, or corporation. Find out how to pay yourself as a business owner.

10 Best Business Savings Accounts For 2024

If you’re a small business owner looking for a place to store your excess cash, you may want to consider a business savings account. The best business savings accounts offer attractive APYs, low fees, and flexible withdrawal options. Learn more.

About Laurie Blank

Laurie Blank is a blogger, freelance writer, and mother of four. She’s psyched about teaching others how to manage their money in a way that aligns with their values and has been quoted in Bankrate.

She’s a licensed Realtor with Edina Realty in Minneapolis, Minnesota (also licensed in Wisconsin too) and has been freelance writing for over six years.

She shares powerful insights on her blog, Great Passive Income Ideas, that will show you how you can create passive income sources of your own.

Opinions expressed here are the author’s alone, not those of any bank or financial institution. This content has not been reviewed, approved or otherwise endorsed by any of these entities.