What Happens When An AcreTrader Farm “Fails”

A week ago, I received a letter from AcreTrader about one of the farms we invested in.

(it’s the Middle River Almond Ranch in San Joaquin County, CA)

Costs were going up, revenues were down, and they were going to run out of money.

- Cost Inflation: Farm input costs (fertilizers, fuel, labor) have skyrocketed, exceeding initial modeled cost projections by 50-100%. California’s regulations further amplify these cost pressures.

- Interest Rate Hike: Borrowing costs have tripled, significantly impacting cash flow, and raising concerns about the Company’s long-term profitability.

- Almond Price Decline: Recent almond sales fell 40% below our modeled target sale prices, impacting our projected income, valuation of the project, and the near-term profitability of almond orchards.

It was time to decide if shareholders wanted to sell the property or put in more cash, to fund the business until things improved.

In the email, they were asking on a vote to decide what to do next.

☝️ Just a point of clarification, technically, the farm hasn’t failed. It’s just losing money and at a decision point where shareholders have to decide what to do next. If things were going well and someone offered to buy the farm, we’d probably be going through a similar process. In a sense, this is a look into what happens at a decision point for a farm on AcreTrader.

In any real estate endeavor, whether it’s farmland or an apartment building, increasing costs is always a risk. If you have revenue that exceeds those costs, then slimmer margins is fine for a little while.

When revenue drops and costs go up, you have a nasty convergence where it’s harder to meet those rent payments.

In this case, there were two options – sell the property or initiate a capital call where investors chip in more money. If you sell the property, they estimate you recover 60-90% of the value. Not great but not tragic.

With a capital call, the idea is that you give it enough cash to survive the challenges. Either rates and costs go down or almond prices go up.

Did the updates suggest a failure?

I didn’t read the bi-annual updates very closely. The updates were also quite brief, only a page or two, with limited financial data. That said, even if they were detailed, I probably wasn’t going to read them closely.

The investment is illiquid, relatively small, and I had zero say (or expertise) in operations. There wasn’t much I could do! I read them for entertainment and not with a keen financial eye.

This is the risk with investments where you’re a limited partner. You have no say.

When I received notice that things were going south, I didn’t know. So, I decided to go back and read the updates. They said that input costs were going up but everyone knew that. Inflation has been significant the last few years.

They mentioned loan costs were also going up, which, we all know because interest rates have gone up.

The updates did give you an idea of the risks but perhaps not the severity.

But again… there’s nothing I can do. I’m not a farmer and I’m a limited partner.

I don’t fault AcreTrader or the operator on reporting, I’m not sure there was much else to say about it.

What can we do next? Sell sell sell!

I voted to sell and recover as much as we can because I don’t see prices going down anytime soon and interest rates aren’t going to fall all that quickly either. I think these challenges will persist for at least another year.

I don’t have a huge share in the farm so I’m not sure what my vote means.

The capital call they’re hoping for is $2.1 million after an initial capital raise of $2.8 million. The property was sold for close to $7 million so I don’t know if the $2.1 million capital call was across all shareholders or just ones through AcreTrader.

Either way, it’s supposed to help them last until 2026… but I’m not looking to double my investment into farmland (or +40% if it’s across all $7 million).

I invested in three farms on AcreTrader and, unfortunately, this is the only property that hasn’t made any distributions. Whatever loss we take on it is what it is, but I don’t think putting more in given the current situation makes a whole lot of sense.

I voted to sell and…

AcreTrader sold the farm in a week!

In one of the fastest actions I’ve ever seen, AcreTrader sold the farm in a week.

I voted on March 13th; I received an email about the sale today, March 20th.

While I suspect this was in the works for a while, only needing the positive vote to consummate it, the fact that it sold this quickly told me two things:

- Things were dire. Other investors felt the same as I did.

- AcreTrader and their partners don’t sit around waiting for things to happen. They weren’t waiting for the vote to then start shopping it around. This is how I’d want things to go.

In the end, they sold it to a local farmer and the sale is scheduled to close in about a month. The farm sold for more than the investment but after debt, interest, and sale costs, investors will walk away with 43% of what they started with. A $2.8 million investment turned into a $1.202 million.

There were a lot of negative factors, including a nearby almond grower going bankrupt and getting sold at the same time… just bad luck. In the initial email, they had hoped to recover 60-90%. So it goes sometimes!

At least this can offset stock market gains! 😆

(who am I kidding… it’s not going to do that, I never sell my stocks!)

This will be the first property that will have any sale activity on it in our AcreTrader portfolio. While I would’ve loved for it to have been a positive result, this is far better than a total loss.

I still like the platform and the asset class (the two other farms are in Louisiana and Illinois, neither of which deal with almonds), but this is a good reminder that not every investment works out.

If you are curious what it’s like to use AcreTrader, our AcreTrader review goes into more detail on the platform.

Other Posts You May Enjoy:

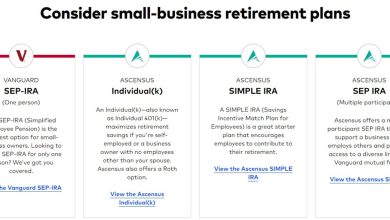

Best Solo 401(k) Providers

A solo 401(k) is a retirement savings plan for self-employed people with no full-time employees. It allows them to save for retirement using pre-tax contributions while benefiting from the same tax advantages in regular 401(k) plans. Here are some of the top solo 401(k) providers available today.

Is Robinhood Gold Worth It?

Robinhood Gold is a $75 per year premium subscription service to Robinhood. It unlocks a few perks but are they worth the annual fee?

Robinhood App Review 2024 – Free Stock, ETF, and Crypto Trades

Robinhood is a popular online broker offering free stock, ETF, crypto, and options trading. They also offer fractional trades, with no account minimums. But the platform doesn’t support some investment types and has limited research tools. Is it worth it? Find out in this Robinhood review.

How do odd lot tenders work?

Do you know what an odd lot tender offer is? It’s when a company offers to pay a premium for an odd lot of their shares, giving smaller investors an investing advantage – see how they work and whether they make sense for you.

About Jim Wang

Jim Wang is a forty-something father of four who is a frequent contributor to Forbes and Vanguard’s Blog. He has also been fortunate to have appeared in the New York Times, Baltimore Sun, Entrepreneur, and Marketplace Money.

Jim has a B.S. in Computer Science and Economics from Carnegie Mellon University, an M.S. in Information Technology – Software Engineering from Carnegie Mellon University, as well as a Masters in Business Administration from Johns Hopkins University. His approach to personal finance is that of an engineer, breaking down complex subjects into bite-sized easily understood concepts that you can use in your daily life.

One of his favorite tools (here’s my treasure chest of tools,, everything I use) is Personal Capital, which enables him to manage his finances in just 15-minutes each month. They also offer financial planning, such as a Retirement Planning Tool that can tell you if you’re on track to retire when you want. It’s free.

He is also diversifying his investment portfolio by adding a little bit of real estate. But not rental homes, because he doesn’t want a second job, it’s diversified small investments in a few commercial properties and farms in Illinois, Louisiana, and California through AcreTrader.

Recently, he’s invested in a few pieces of art on Masterworks too.

Opinions expressed here are the author’s alone, not those of any bank or financial institution. This content has not been reviewed, approved or otherwise endorsed by any of these entities.