How to Cancel a Credit Card without Lowering Your Credit

If you no longer need a credit card, your intuition would tell you to cancel it. Cut up the card and toss the pieces in the trash.

But canceling a card can lower your credit score because of how the credit score calculation.

If you no longer need a credit card, here’s how to safely deal with it without putting any pressure on your credit or credit score.

Table of Contents

We’ll first go into the methods for safely canceling a card and then explain why you need to take these measures.

Steps to Safely Cancel a Credit Card

1. Consider Sticking it in a Safe Place

I never cancel a credit card because of how it can lower your credit score so if you’re comfortable with the idea, just leave the card open but put it in a safe place. This keeps the line open on your report and your credit limit as high as possible, so your utilization remains lower.

Then, make sure you use the card every few months so that the issuer doesn’t cancel it for inactivity. it doesn’t matter if they cancel it or you do, the negative impact is the same.

2. Redeem Rewards

If you have any outstanding rewards on the credit card you want to close, and you don’t use them before you close the account, there’s a good chance those rewards will be forfeited. Sometimes, if the rewards are through a different company, such as a hotel or airline, you can keep them because they’re tied to the hotel or airline and not the credit card.

To avoid all this, just use use the rewards. Find out if the credit card company will cut you a check or what the procedure is to get your rewards balance.

Then follow those procedures before you close the card. If you have to wait for a certain timeline to be met before you can get your rewards, explain your situation and ask if you can get them early because you want to close the card.

If the credit card company refuses to issue your rewards early, you may want to wait on closing the card until you can redeem the rewards.

3. Pay Off Outstanding Balances

After you’ve taken care of getting any rewards, it’s a good idea to pay off the card in full. This isn’t required but it’s a good idea since once you close the account the bank has no reason to extend any courtesies, such as waiving a fee or lowering your interest rate.

First, call the credit card company to get the current payoff amount. Don’t go off your most recent credit card statement or your online balance as there can be interest that is due but not yet applied to that balance.

Therefore, call and get the payoff balance and find out what date it is good through. Then pay the balance in full before the specified due date.

That way you eliminate any possibility of closing a card and leaving an unpaid balance that could affect your credit unbeknownst to you.

4. Ask to Have the Account Downgraded or Closed

Here’s where there’s a bit of “credit score strategy” comes into play.

If you want to close a credit card because you don’t want to pay an annual fee, you can ask the credit card company to “downgrade” your card to one without an annual fee. This maintains your limit and potentially the credit line’s history while also removing an annual fee.

This is when the credit card issuer may offer to waive the annual fee, which solves your fee problem, or they downgrade you, which again solves your fee problem.

If they can’t do either, or you’re set on cancelling the card, then closing is the way to go.

Call the number on the back of the credit card for guidance. If you don’t have the card, you can find the number on your statement or online.

During your call, be sure to ask the credit card company if they’ll mail out a verification letter regarding the card closing. Some companies might not do that, but most will.

5. Confirm Closure on Your Credit Report

About six weeks after you’ve closed the account, you’ll want to check your credit report to ensure the card was indeed closed just to be sure.

You can go to AnnualCreditReport.com to get your credit reports from each of the bureaus each week.

When you’ve gotten your report, check and see that the account for the card you’ve closed does indeed reflect that it’s closed. Doing so will help prevent any fraudulent activity on the card in the future.

So, how does canceling or closing a card affect your score?

How Cancelling Can Affect Your Credit Score

When talking about how to cancel a credit card safely, you might be wondering what the big deal is. After all, it’s not like the issuing bank of said credit card will hunt you down, forcing you to use the card “or else.”

Here’s how it can impact your score:

Your Credit Utilization Ratio (Amounts Owed)

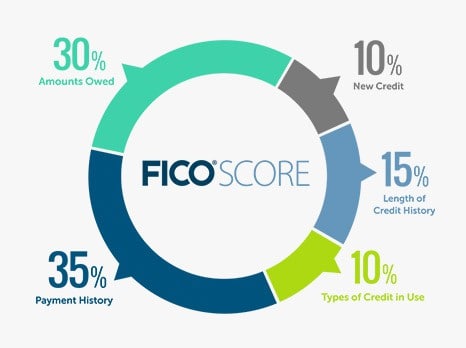

A Credit Utilization Ratio is an important factor in your credit score – it accounts for 30% of your FICO credit score. Your credit utilization ratio is determined by dividing the amount of credit card debt you have by the total available credit you have.

If your total credit card limits is $20,000 and you have outstanding credit card balances of $10,000, you have a credit utilization ratio of 50%. If you pay those credit card balances down to $5,000, your credit utilization ratio drops down to 25%.

Credit reporting agencies like to see a person’s credit utilization ratio at 30% or less.

Now, let’s take that same scenario assuming you’ve got the $5,000 in credit card debt and $20,000 of total credit card limits. Your ratio is 25%.

If you close a credit card with a $10,000 limit and are left with $10,000 in total credit card limits, your ratio will then rise to 50%.

And that leaves a potential to drop your credit score because it looks like you’re using a larger portion of your available credit, when, in fact, your outstanding credit card balances are the same.

Your Payment History

Another way closing a credit card in a risky manner can hurt you has to do with your payment history, which accounts for 35% of your score. If the credit card you’re considering closing is one that you’ve held for many years, a good payment history on the card is a positive factor in your good credit score.

If you close that card and are only left with cards that haven’t been opened for very long, it can appear as if your credit usage history is shorter than it actually is.

The score also factors into the average age of your credit lines so in some cases, canceling a newer card may have a small positive benefit but this is generally rarer.

Other Posts You May Enjoy:

Amex Gold vs. Platinum: Which Rewards Credit Card is Better?

The American Express Gold and Platinum cards are among the most prestigious rewards credit cards available today. Both offer generous point rewards earning capability and feature a long list of additional travel and lifestyle benefits. So which card is the better of the two? Find out in this head to head comparison.

10 Best 2% Cash Back Credit Cards

The most prestigious credit cards offer generous rewards, but it can be a pain to remember what the rewards structure is. Keep it simple with this list of the best 2% cash back cards – nothing to remember, just 2% cash back.

What Is the Easiest Credit Card to Get Approved For?

Some credit cards are geared for college students, people who are rebuilding their credit, or people who have yet to establish credit But with so many credit cards to choose from, which is the easiest credit card to get? Here are fourteen credit cards that offer solid benefits and are easy to qualify for.

Capital One Venture X Card Review: 13 Reasons to Apply Today

The best travel credit cards offer generous welcome bonuses, annual travel credits, insurance coverages, and many other perks for frequent travelers. Is the Capital One Venture X Card worth putting on your travel credit card shortlist? Find out in our Capital One Venture X Card Review.

About Jim Wang

Jim Wang is a forty-something father of four who is a frequent contributor to Forbes and Vanguard’s Blog. He has also been fortunate to have appeared in the New York Times, Baltimore Sun, Entrepreneur, and Marketplace Money.

Jim has a B.S. in Computer Science and Economics from Carnegie Mellon University, an M.S. in Information Technology – Software Engineering from Carnegie Mellon University, as well as a Masters in Business Administration from Johns Hopkins University. His approach to personal finance is that of an engineer, breaking down complex subjects into bite-sized easily understood concepts that you can use in your daily life.

One of his favorite tools (here’s my treasure chest of tools,, everything I use) is Empower Personal Dashboard, which enables him to manage his finances in just 15-minutes each month. They also offer financial planning, such as a Retirement Planning Tool that can tell you if you’re on track to retire when you want. It’s free.

Opinions expressed here are the author’s alone, not those of any bank or financial institution. This content has not been reviewed, approved or otherwise endorsed by any of these entities.