Chase Business Complete Banking Review

Chase Business Complete Banking

![]()

Product Name: Chase Business Complete Banking

Product Description: Chase Business Complete Banking is a solid choice for many small businesses due to its wide range of products and services and extensive branch and ATM network.

Summary

Chase Business Complete Banking is a small business checking account that can grow with your business. Chase is a full service bank with branches nationwide. There is a $15 monthly fee that can be waived by meeting the requirements.

Pros

- No fees for electronic or ATM transactions

- No fees on deposits up to $5,000 in cash per statement cycle

- The monthly service fee can be waived

- No minimum deposit requirement

- Nearly 5,000 branches and 17,000 ATM locations

Cons

- $15 monthly fee (waivable)

- The account is not interest-bearing

- The fee structure is somewhat complicated

Chase Business Complete Banking, an entry-level business checking account with features that can make managing your day-to-day business operations easier.

It does have a $15 monthly fee, which can be waived by meeting one of a few requirements, one of which is maintaining a $2,000 minimum balance. You can deposit up to $5,000 in cash per month for free at one of the many physical locations.

If you are building a growing business that will need more sophisticated banking support in the future, Chase might be a great place to get started.

At a Glance

- $15 monthly fee (can be waived)

- No minimum account balance requirement

- Unlimited debit card purchases and ATM transactions

- Send and receive funds via wire transfer, Chase QuickDeposit, and Chase Online Bill Pay

- Up to $5000 no-fee cash deposits per statement cycle

- Additional debit and employee deposit cards available upon request

- Access to Chase Business Online

- Non-interest bearing account

- Mobile app is available for iOS and Android devices

Who Should Use Chase Business Complete Banking

Chase Business Complete Banking is best for those who can meet the requirements for waiving the $15 per month fee. These include maintaining a balance of at least $2,000 or charging at least $2,000 to a Chase Ink Business credit card per statement cycle.

Chase is also a great choice for businesses that deal with cash since Chase has branches nationwide for easy cash deposits. It’s also a good fit for business owners who will be looking for more business banking services in the future. Chase is the largest bank in the U.S. so your business will not outgrow this bank.

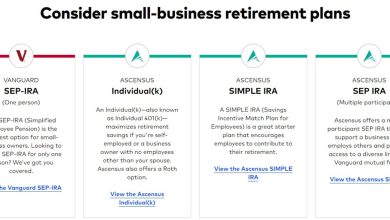

Chase Business Complete Banking Alternatives

|

|

||

| Monthly Fee | $0-$30 | $0 | $0 |

| Minimum Deposit | $0 | $0 | $0 |

| In-Person Banking | Yes, 26 states | No | No |

| Learn More | Learn More | Learn More |

Table of Contents

- At a Glance

- Who Should Use Chase Business Complete Banking

- Chase Business Complete Banking Alternatives

- What Is Chase Business Complete Banking?

- Chase Business Complete Checking Welcome Offer

- Chase QuickAccept

- Chase QuickDeposit

- Chase Customer Service

- Chase Business Complete Banking Fees

- Chase Business Complete Banking Alternatives

- FAQs

- Final Thoughts

Chase Bank is a part of New York City-based J.P. Morgan Chase, the largest banking organization in America. With total assets of $4 trillion, nearly 5,000 local branches, and 16,000 ATMs across the country, it’s no surprise that Chase is also one of the top business banks in the U.S.

Chase Business Complete Banking is Chase’s entry-level business banking account. It’s one of three Chase business checking accounts offered by the bank, the other two being the Chase Performance Business Checking and the Chase Platinum Business Checking.

Chase Business Complete Checking Welcome Offer

Until April 18/2024, if you open a Chase Business Complete Checking account (new business account holders only), you can be eligible to receive a $400 welcome bonus as long as you complete the following qualifying activities:

- Deposit $2,000 or more in new money into your new checking account within 30 days of offer enrollment.

- Maintain at least a $2,000 balance for 60 days from the offer enrollment. The new money cannot be funds held by your business at Chase or its affiliates.

- Complete five qualifying transactions within 90 days of offer enrollment.

Qualifying transactions are: Debit card purchases, accepting credit and debit card payments with QuickAccept®, Chase QuickDeposit℠, ACH (Credits), wires (Credits and Debits), and Chase Online℠ Bill Pay.

✨ Related: Chase Bank Promotions

Chase QuickAccept

Chase QuickAccept allows you to accept credit card payments in person and over the phone. The feature offers same-day deposits so you can access customer payments quickly and manage payments, refunds, and reports via a mobile app or through Chase Business online.

Chase QuickDeposit

For businesses that receive a large number of checks, Chase has a remote check scanning product called Chase QuickDeposit. With QuickDepost, you can scan checks from your home or office and deposit them into your account electronically. The best part is that you have access 24/7, so you don’t have to wait until the bank branch is open to deposit checks.

Chase QuickDeposit can accept personal and business checks, U.S. Treasury checks, travelers’ checks, and money orders.

Chase Customer Service

As a large national bank, Chase offers several different support channels for when you need help.

- By Phone: Business Customer Service: 1-800-CHASE38 (1-800-242-7338)

- Secure Message Center: Log in to Chase Business Online to send a message

- X.com (Twitter) Business Support Handle: @ChaseSupport

- In-person: Visit one of Chase’s 4700 branches to speak with a customer service representative

Get Started with Chase Business Complete Banking

Chase Business Complete Banking Fees

Unlike many online business checking accounts, Chase charges a $15 monthly fee for its Business Complete Banking account. However, the fee can be waived in several ways. Chase also offers unlimited debit card and Chase ATM transactions and up to 20 teller and paper transactions per statement period.

Here’s a closer look at the fees involved with this account.

Monthly Maintenance Fee: $15

The monthly fee can be waived if any of the following are true during each statement period:

- Maintain a minimum daily balance of $2,000.

- Make at least $2,000 in net purchases on your Chase Ink Business Card(s).

- Make at least $2,000 in deposits from Chase QuickAccept or other eligible Chase payment solutions transactions.

- Link a Chase Private Client Checking account.

- Provide qualifying proof of military status.

Other Account Fees:

- Teller Deposits and Checks written: Free up to 20; 21+, $0.40 each.

- Cash deposits: No fee for the first $5,000 per statement period, then $2.50 per $1,000.

- Out-of-network ATM use: $3 per transaction

- Incoming wire transfers: $15 domestic or international ($0 if the transfer was originally sent with the help of a Chase banker or using Chase.com or Chase Mobile).

- Outgoing wire transfers: Up to $50 per transfer

- Swipe, Dip & Tap transactions: 2.6% plus $0.10.

- Manual entry and payment link transactions: 3.5% plus $0.10.

The $15 monthly fee may be a turn-off for business owners with a lower volume business. You may want to consider a different account if that’s the case for you. Here’s our list of the best business checking accounts.

Get Started with Chase Business Complete Banking

Chase Business Complete Banking Alternatives

If you don’t need to bank in person and want to avoid as many fees as possible, the following business banking options might be more suitable than Chase Business Complete Banking.

U.S. Bank Business Checking

U.S. Bank has more than 2,000 in 26 states. If you want in-person banking and live in one of those 26 states, then U.S. Bank might be a viable alternative to Chase.

There are a few options: the Silver package has no monthly fee but only allows for 125 free transactions per month, then it’s $0.50 per transaction after that.

The Gold package is $20 per month and allows for 300 free transactions; each additional transaction is $0.45 each. You can waive the monthly fee by meeting minimum balance requirements, including $10,000 per month in the checking account.

The Platinum package has a $30 annual fee and allows for 500 free transactions; each additional transaction is $0.40 each. You can waive the monthly fee by meeting minimum balance requirements, including $25,000 per month in the checking account.

Axos Bank

Axos Bank is an online bank offering a basic business checking account with no monthly fees, minimum balance requirement, free incoming domestic wires, and unlimited transactions. It also offers unlimited reimbursement for domestic ATM transactions. Small business owners can also access merchant services, payroll processing, treasury management, and SBA loans.

The major disadvantage compared with Chase is that they have no brick-and-mortar branches. But if that doesn’t matter to you, Axos Bank can be an excellent choice.

Learn more in our full Axos Bank review.

Novo

Novo is on our list of the best bank accounts for freelancers and side hustlers. It’s a fintech that offers a business banking account through its partnership with Middlesex Federal Savings. The business checking account has no monthly maintenance fees, no minimum balance requirement, and unlimited transactions. One limitation is that ATM fees are reimbursed only up to $7 per month, which can become costly if you are a frequent ATM user.

Novo’s business checking account integrates with popular online services, including Stripe, Shopify, Etsy, eBay, Gusto, QuickBooks, Xero, Zapier, and Slack. It even provides free invoicing capabilities. Novo seems to be an especially good choice if you run a primarily online business.

✨ Related: Best Business Savings Accounts

FAQs

Is Chase Bank good for business bank accounts?

Chase is ideal for business banking because it’s the largest bank in America and a full-service commercial bank. That means they have services to cover nearly any business need, including international transactions. They also offer plenty of savings and investment options, as well as loans and business credit cards.

What is the limit on Chase Business Complete Checking transactions?

As described in the section above, there are unlimited electronic transactions. There are also no fees for up to 20 transactions involving branch tellers, as well as $5,000 in fee-free cash deposits. However, fees will apply to transactions exceeding these limits.

What is the minimum balance for a Chase Business Complete Checking account?

In general, the minimum balance is $2,000. You can maintain a lower balance, but a $15 monthly service fee will apply. That fee can be waived if you meet minimum transaction requirements or you can supply proof of qualifying military status.

What is the withdrawal limit for a Chase Business Complete Checking account?

Chase has a daily limit on debit card purchases of $10,000. There is also a Chase in-branch ATM withdrawal limit of $3,000, and a non-branch Chase ATM withdrawal limit of $1,000. Daily withdrawals from non-Chase ATMs are limited to $500.

Get Started with Chase Business Complete Banking

Final Thoughts

If you’re looking for an affordable business checking account from a truly full-service bank, particularly one that can specialize in international transactions, Chase’s Business Complete Banking is an excellent choice.

While online banks like the ones mentioned above are very convenient, they don’t have the same range of products and services as national banks like Chase.

That said, if you are a small business that doesn’t deal with cash, you might find Chase a bit too costly. Not only that, but their fees are complicated. This includes the monthly fee waiver criteria, deposit item limits, and incoming and outgoing wire transfer fees.

But if Chase is the right choice for you, you can open an account by visiting a local branch or applying on the Chase website.

Other Posts You May Enjoy:

Found Business Banking Review: A Freelancer’s Dream?

Found is a business banking fintech that offers a free business checking account with integrated tools to automate various aspects of your business, from reporting to invoicing to payments, and more. Is Found right for your business? Learn more in this Found review.

How to Pay Yourself as a Business Owner

Figuring out how to pay yourself is one of the first things you need to figure out when starting a business. But it’s a complicated matter, especially if you’ve established your business as a partnership, LLC, or corporation. Find out how to pay yourself as a business owner.

10 Best Business Savings Accounts For 2024

If you’re a small business owner looking for a place to store your excess cash, you may want to consider a business savings account. The best business savings accounts offer attractive APYs, low fees, and flexible withdrawal options. Learn more.

How to Open a Business Checking Account

The very thought of having to open a business checking account can cause stress. But that’s largely due to the unfamiliarity many people have with business banking products. With the proper research and the right documentation up front, it can be a seamless process. In this article, we show you how to open a business checking account. Learn more.

About Kevin Mercadante

Since 2009, Kevin Mercadante has been sharing his journey from a washed-up mortgage loan officer emerging from the Financial Meltdown as a contract/self-employed “slash worker” – accountant/blogger/freelance blog writer – on OutofYourRut.com. He offers career strategies, from dealing with under-employment to transitioning into self-employment, and provides “Alt-retirement strategies” for the vast majority who won’t retire to the beach as millionaires.

He also frequently discusses the big-picture trends that are putting the squeeze on the bottom 90%, offering workarounds and expense cutting tips to help readers carve out more money to save in their budgets – a.k.a., breaking the “savings barrier” and transitioning from debtor to saver.

Kevin has a B.S. in Accounting and Finance from Montclair State University.

Opinions expressed here are the author’s alone, not those of any bank or financial institution. This content has not been reviewed, approved or otherwise endorsed by any of these entities.