Neobanking in Transition: Opportunities and Obstacles in a $6.37 Trillion Transaction Era

Neobanking is taking off across the world, seeing faster and more transparent financial solutions entering the market and proving successful among consumers. In 2024, neobanking transaction values are projected to reach more than $6.37 trillion, surpassing the GDP of Japan, the third largest economy globally.

With more people than ever banking online, and consumers in developing regions seeking affordable, reliable, and faster peer-to-peer and cross-border payment solutions, neobanking is perhaps only at the cusp of completely revolutionizing the global financial landscape.

How Neobanks Came to Be

For nearly a decade, neobanking has been reshaping how businesses conduct transactions and consumers can leverage financial technology solutions. The term ‘neobanks’ was first coined back in 2017. However, by this time the technology and financial software capabilities provided by these startups had been around since 2013.

Fast-forward past a pandemic, the supersonic rise of remote working, economic turbulence, and neobanking is fast taking on a new form, proving to be more efficient and reliable compared to traditional banks.

Although neobanks’ success isn’t solely embedded in the fast and reliable services these companies can offer, but rather in the technology that has helped it rise to the occasion over the last decade.

Cloud-Based Technology

One thing that has helped set neobanks apart from traditional brick-and-mortar-like banks is the use of cloud-based technology and Application Programming Interfaces (APIs). By leveraging cloud technology, neobanks can seamlessly connect to third-party providers such as traditional banks and provide consumers with various financial services all under one umbrella.

Yet, cloud technology was only the beginning. Today, neobanks heavily rely on the advancements of artificial intelligence (AI) to help supercharge the customer experience and machine learning, gather customer data, and provide all-in-one automated service solutions.

White-Label Digital Banking Solutions

Part of the success of neobanks is their ability to provide white-label digital banking solutions to larger and more established vendors. Instead of solely targeting the everyday consumer, neobanks have instead gone to partner and collaborate with larger financial institutions, helping to provide them with a more advanced and efficient payment platform.

This allows major financial conglomerates to expand their digital footprint, enter new markets, scale their services, and broaden their product range. In this case, neobanks simply act as the provider of the platform, while traditional banks operate and trade under their own brand.

Embedded Banking Services

As with anything nowadays, consumers and businesses seek convenience, looking to have a variety of personalized financial solutions all under one branch. That’s where neobanks have stepped in, providing clients with the ability to transact, lend, and manage their accounts within one ecosystem.

Solutions including business-to-consumer, business-to-business, and banking-as-a-service are all key elements that help make neobanks stand apart from traditional financial options. Individuals and businesses can now manage payment solutions, and other financial tasks, such as accounting, payroll, lending, debit cards, credit cards, and investments under one roof.

Profitability – A Key Challenge for Neobanks

Neobanks have managed to disrupt the industry in recent years, however, many of them are still struggling to turn a profit. In one report by Simon-Kucher & Partners, analysts found that despite there were more than 400 neobanks currently scattered across the world, an estimated 5 percent of them break even.

Yet, despite all of the success neobanks have accomplished, and seriously challenging incumbent banks, there’s still a lot of growing uncertainty being faced within the digital financial ecosystem.

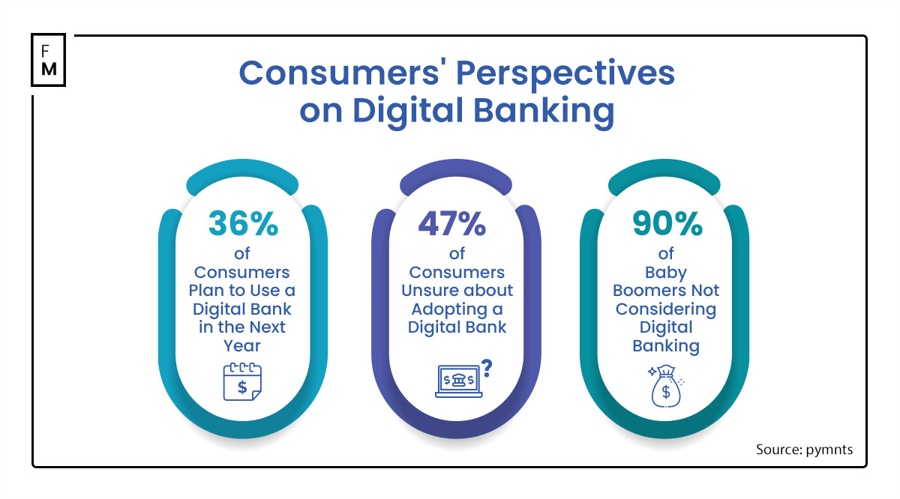

For instance, a recent PYMNTS Intelligence report found that an estimated 9 percent of consumers currently make use of fintechs as their primary bank. While it’s possible to see this figure expand in the coming years, 47 percent of consumers said that they remain hesitant to use digital-only banks and fintechs.

Some of the neobanks (Chime, Monzo, Starling) operate with uneven profitability. Chime for example generates the majority of its income from Visa, garnering revenue from fees, and customers using cards at out-of-network ATMs.

Supreme Court greenlights class-action lawsuit against Visa, Mastercard over ATM swipe fees. httpss://t.co/1DBuanubj6

— PYMNTS (@pymnts) April 16, 2024

Similarly, Monzo generates roughly 75 percent of its income through interchange fees, while Chime and Starling receive some portion of their income through these fees. However, both Mastercard and Visa have said that they will reduce interchange rates by about 0.05% over several years.

Neobanks are evolving their offerings to capture more of the consumer market, including providing new lines of credit and subordinated debt to improve their capital structures. Subordinated debt, an unsecured type of debt used after obtaining senior debt, offers neobanks a means to secure additional financing, albeit at higher risk and interest rates.

While these instruments could enhance profitability, other options like insured deposits and subordinate equity play vital roles. Competition drives neobanks to offer attractive features, but monetizing them demands long-term investment, potentially impacting short-term profitability. To sustain growth, neobanks must establish robust capital structures that secure funding for innovative financial solutions without diluting ownership.

A Gateway of New Problems

Neobanks are expanding their product offerings to meet the needs of the financial consumer market, but face challenges including scrutiny over lending practices and concerns about predatory lending, particularly in developing regions where digital banking is on the rise. Reports indicate abuse of digital banks’ lending services, prompting regulatory transformations supported by governments.

Seamless B2B payments are crucial in today’s digital economy while outdated infrastructure hinders efficiency and transparency.

Learn how blockchain and AI solutions are transforming the landscape, offering speed, security, and cost savings. httpss://t.co/05OYlzIGlA

— Ripple (@Ripple) April 16, 2024

However, incumbent banks question the long-term impact on consumers and the financial ecosystem. Neobanks additionally grapple with liquidity access, potential solutions involving strategic partnerships and diverse market segments. Regulatory compliance and the implications of subordinated debt structures complicate their evolution within the banking ecosystem.

Final Thoughts

Neobanks help to connect consumers and businesses to a bigger, and more sophisticated network, however, for many the challenges of profitability remain one of their biggest barriers to scalability . Yet, as we begin to better understand neobanks’ place within the broader financial ecosystem, and consider where it’s heading, perhaps the challenges we’re facing could become the next generation of solutions for the wider financial environment.

Neobanking is taking off across the world, seeing faster and more transparent financial solutions entering the market and proving successful among consumers. In 2024, neobanking transaction values are projected to reach more than $6.37 trillion, surpassing the GDP of Japan, the third largest economy globally.

With more people than ever banking online, and consumers in developing regions seeking affordable, reliable, and faster peer-to-peer and cross-border payment solutions, neobanking is perhaps only at the cusp of completely revolutionizing the global financial landscape.

How Neobanks Came to Be

For nearly a decade, neobanking has been reshaping how businesses conduct transactions and consumers can leverage financial technology solutions. The term ‘neobanks’ was first coined back in 2017. However, by this time the technology and financial software capabilities provided by these startups had been around since 2013.

Fast-forward past a pandemic, the supersonic rise of remote working, economic turbulence, and neobanking is fast taking on a new form, proving to be more efficient and reliable compared to traditional banks.

Although neobanks’ success isn’t solely embedded in the fast and reliable services these companies can offer, but rather in the technology that has helped it rise to the occasion over the last decade.

Cloud-Based Technology

One thing that has helped set neobanks apart from traditional brick-and-mortar-like banks is the use of cloud-based technology and Application Programming Interfaces (APIs). By leveraging cloud technology, neobanks can seamlessly connect to third-party providers such as traditional banks and provide consumers with various financial services all under one umbrella.

Yet, cloud technology was only the beginning. Today, neobanks heavily rely on the advancements of artificial intelligence (AI) to help supercharge the customer experience and machine learning, gather customer data, and provide all-in-one automated service solutions.

White-Label Digital Banking Solutions

Part of the success of neobanks is their ability to provide white-label digital banking solutions to larger and more established vendors. Instead of solely targeting the everyday consumer, neobanks have instead gone to partner and collaborate with larger financial institutions, helping to provide them with a more advanced and efficient payment platform.

This allows major financial conglomerates to expand their digital footprint, enter new markets, scale their services, and broaden their product range. In this case, neobanks simply act as the provider of the platform, while traditional banks operate and trade under their own brand.

Embedded Banking Services

As with anything nowadays, consumers and businesses seek convenience, looking to have a variety of personalized financial solutions all under one branch. That’s where neobanks have stepped in, providing clients with the ability to transact, lend, and manage their accounts within one ecosystem.

Solutions including business-to-consumer, business-to-business, and banking-as-a-service are all key elements that help make neobanks stand apart from traditional financial options. Individuals and businesses can now manage payment solutions, and other financial tasks, such as accounting, payroll, lending, debit cards, credit cards, and investments under one roof.

Profitability – A Key Challenge for Neobanks

Neobanks have managed to disrupt the industry in recent years, however, many of them are still struggling to turn a profit. In one report by Simon-Kucher & Partners, analysts found that despite there were more than 400 neobanks currently scattered across the world, an estimated 5 percent of them break even.

Yet, despite all of the success neobanks have accomplished, and seriously challenging incumbent banks, there’s still a lot of growing uncertainty being faced within the digital financial ecosystem.

For instance, a recent PYMNTS Intelligence report found that an estimated 9 percent of consumers currently make use of fintechs as their primary bank. While it’s possible to see this figure expand in the coming years, 47 percent of consumers said that they remain hesitant to use digital-only banks and fintechs.

Some of the neobanks (Chime, Monzo, Starling) operate with uneven profitability. Chime for example generates the majority of its income from Visa, garnering revenue from fees, and customers using cards at out-of-network ATMs.

Supreme Court greenlights class-action lawsuit against Visa, Mastercard over ATM swipe fees. httpss://t.co/1DBuanubj6

— PYMNTS (@pymnts) April 16, 2024

Similarly, Monzo generates roughly 75 percent of its income through interchange fees, while Chime and Starling receive some portion of their income through these fees. However, both Mastercard and Visa have said that they will reduce interchange rates by about 0.05% over several years.

Neobanks are evolving their offerings to capture more of the consumer market, including providing new lines of credit and subordinated debt to improve their capital structures. Subordinated debt, an unsecured type of debt used after obtaining senior debt, offers neobanks a means to secure additional financing, albeit at higher risk and interest rates.

While these instruments could enhance profitability, other options like insured deposits and subordinate equity play vital roles. Competition drives neobanks to offer attractive features, but monetizing them demands long-term investment, potentially impacting short-term profitability. To sustain growth, neobanks must establish robust capital structures that secure funding for innovative financial solutions without diluting ownership.

A Gateway of New Problems

Neobanks are expanding their product offerings to meet the needs of the financial consumer market, but face challenges including scrutiny over lending practices and concerns about predatory lending, particularly in developing regions where digital banking is on the rise. Reports indicate abuse of digital banks’ lending services, prompting regulatory transformations supported by governments.

Seamless B2B payments are crucial in today’s digital economy while outdated infrastructure hinders efficiency and transparency.

Learn how blockchain and AI solutions are transforming the landscape, offering speed, security, and cost savings. httpss://t.co/05OYlzIGlA

— Ripple (@Ripple) April 16, 2024

However, incumbent banks question the long-term impact on consumers and the financial ecosystem. Neobanks additionally grapple with liquidity access, potential solutions involving strategic partnerships and diverse market segments. Regulatory compliance and the implications of subordinated debt structures complicate their evolution within the banking ecosystem.

Final Thoughts

Neobanks help to connect consumers and businesses to a bigger, and more sophisticated network, however, for many the challenges of profitability remain one of their biggest barriers to scalability . Yet, as we begin to better understand neobanks’ place within the broader financial ecosystem, and consider where it’s heading, perhaps the challenges we’re facing could become the next generation of solutions for the wider financial environment.