This low-risk stock could return 7.53% in three weeks

On March 13th, Cummins will give you $107.53 of value for every $100 of Cummins stock. It’s a 7.53% return in less than a month.

It’s known as an odd lot tender offer and one of the only ways a smaller investor has an advantage of institutional investors.

But what is an odd lot tender offer?

A tender offer is a bid to purchase a shareholder’s stock and an odd lot is when you have 1 – 99 shares. A round lot is when your number of shares is evenly divisible by 100 – so 100, 200, 300, etc.

Thus, an odd lot tender offer is when a company offers to buy back its own shares with a separate provision for those with “odd lots,” or less than 100 shares. These can be called odd lot buybacks.

Sometimes, a company doesn’t make a firm offer but instead conducts a Dutch auction to establish a price. A Dutch auction is when the price starts high and is lowered until the number of bids meets the number of shares the company wants to buy back.

Finally, a company only wants to acquire a certain number of shares. If the offer is oversubscribed, which is when the number of shares exceeds what the company wants, they will pro-rate how many shares each shareholder can sell. They often make exceptions to odd lots because they are so small and this is where you come in.

I’ve been reading about odd lot tenders for quite some time, usually because Jonathan at My Money Blog writes about them (the latest involves Cummins and Atmus Filtration), but I’ve never participated.

Today, I just might.

Table of Contents

What is the Cummins & Atmus Filtration Deal?

Cummins (NYSE: CMI) spun off Atmus Filtration (NYSE: ATMU) but still owns 80% of ATMU’s stock.

They’d like to own less, so they’re offering $107.53 of ATMU for every $100 of CMI stock. There’s no Dutch auction on this one, just an offer.

The upper limit is 13.3965 shares of Atmus Common Stock per share of Cummins Common Stock and there is no lower limit (no minimum exchange ratio).

Before the market opened on February 26th, Atmus shares were valued at $22.81 and CMI stock was valued at $263.97. That’s a ratio of 11.57 so we’re still under the upper limit.

- What is the tender offer? Get $107.53 of ATMU for every $100 of CMI

- What is the upper limit ratio? 13.3965 shares of ATMU to CMI

- What is the lower limit ratio? No lower limit.

- When is the expiration date of the offer? March 13, 2024.

What Are The Benefits?

The benefits are that you own an odd lot, you accept the tender, and you receive $107.53 of ATMU stock for every $100 of CMI stock. That’s a 7.53% return in less than a month.

If you buy 99 shares of CMI at $263.97, that’s a total value of $26,133.03. You would get ~$28,100.84 of ATMU, for a gain of $1,967.81.

Once you get the ATMU stock, they are yours to do as you wish. You can sell the shares or hold onto them.

Since odd lots max out at 99 shares, this is usually attractive to smaller investors or financial advisors who want to take advantage of this arbitrage opportunity to offset fees.

What Are The Risks?

Odd lot tenders are not guaranteed profits.

There are quite a few risks.

The biggest risk, though extremely rare, is that the deal is withdrawn or terminated. This rarely happens but is possible. There are several conditions in which the offer could fail to go through. The most likely (and this is extremely unlikely) one is if there are not enough shares being sold back (not enough ATMU stock being sold to CMI). Another one is if they receive “an opinion of counsel that the exchange offer will qualify for tax-free treatment to Cummins and its participating stockholders.” (from their press release)

If this happens, the stock will likely go down. Some of the shareholders were only owning it for the odd lot tender offer, so those investors will sell their shares.

The deal could be extended. The current deadline in March may be extended for whatever reason and this would reduce the total return from the deal since the holding period is increased.

The next major risk is that the respective stock prices move in such a way that you now exceed the upper limit ratio. If you exceed the upper limit ratio, the amount of ATMU stock you get for your CMI stock will go down. Your 7.53% premium gets smaller.

The stock can also go down in price while you await the tender. CMI stock continues to trade and its price will change. If it goes up, fantastic! If it goes down, that eats into your returns.

Finally, the last risk is that the stock prices go down after the sale (and it most likely will go down). All those ATMU shares that were in CMI coffers are now in shareholder hands. Some of those shareholders were only in it for the arbitrage opportunity so they’re selling the moment they get the shares.

The only question is whether this pressure will be greater than the premium and how quickly will you be able to sell the shares.

One risk you won’t face is being prorated. What’s nice about odd lot tenders is that you don’t have to worry about the risk of pro-ration – since odd lots are not subject to pro-ration.

How Do You Accept The Tender Offer?

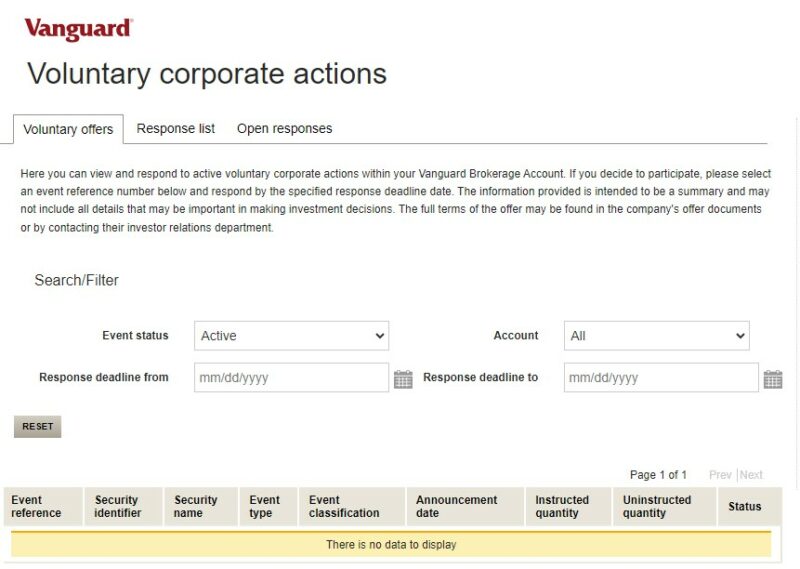

As a matter of protocol, if you own an odd lot and do not accept the tender, you’ve effectively declined it. It’s a voluntary corporation action. If you miss the notice and don’t respond, you’ve effectively declined it. (corporate actions that are mandatory are mergers, stock splits, spin offs, etc.)

The deadline for the CMI/ATMU offer is March 13th but some brokerages may need you to respond ahead of that date.

Let’s say you own an odd lot of a company that has made an odd lot tender, how do you go about accepting it? This will vary from brokerage to brokerage. Some will have a way to do it online, others will require you to call in.

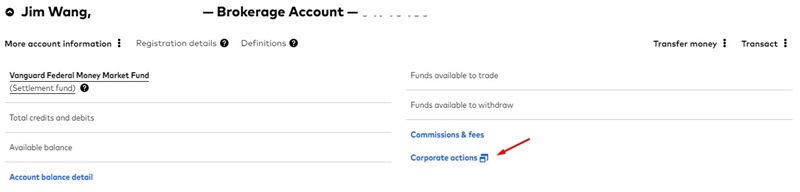

In Vanguard, there’s Corporate actions menu in your brokerage account view:

This opens a window where you can respond to Voluntary corporate actions:

As of this writing I don’t own any shares of CMI so there are no corporation actions to show.

Once you accept the offer, you’ll likely get the shares of ATMU about 7 business days after the deadline.

Why Do Companies Do This?

There are a lot of reasons. For some, they want to reduce the number of shareholders.

Sometimes a company owns a large portion of another company, either by spinoff or some other action, and they want to take advantage of it to improve their share price. In 2023, Johns & Johnson (NYSE: JNJ) spun off its consumer staples unit, Kenvue (NYSE: KVUE), and held 90% of the company. J&J offered to buy back its stock using shares of Kenvue, rather than cash and did so at a 7.5% premium. For every $100 of JNJ it purchased, it would give the shareholder $107.53 in KVUE stock.

Whatever the reason, the beneficiary is you, the smaller investor, because you can (potentially) earn a quick premium.

Other Posts You May Enjoy:

Betterment Review 2024 – Is Betterment Worth It?

Betterment is one of the original robo-advisor platforms, but in recent years, it’s expanded its product lineup to include a High-Yield Cash Reserve account, a no-fee checking account, and access to financial planning advice. How does it compare to other top robo-advisors? Find out in this Betterment review.

Apps Like Acorns

Acorns is a popular investing app with a round-up saving feature that automates the investing process. However, it’s far from the only investing app available. Here are six more apps like Acorns. Learn more.

E*Trade Review (2024): Features, Pricing, Pros and Cons

E*Trade is an online brokerage offering free stock and ETF trades, along with managed investment portfolios. But with no fractional investing or ability to buy and sell crypto tokens, it might not be for everyone. Learn more in our E*Trade review.

ESOP vs. ESPP: What You Need to Know

Employee Stock Ownership Plans (ESOPs) and Employee Stock Purchase Plans (ESPPs) are valuable employee benefits that not all companies offer. Here’s what you need to know about their similarities, differences, tax treatments, and whether or not you should sign up. Learn more.

About Jim Wang

Jim Wang is a forty-something father of four who is a frequent contributor to Forbes and Vanguard’s Blog. He has also been fortunate to have appeared in the New York Times, Baltimore Sun, Entrepreneur, and Marketplace Money.

Jim has a B.S. in Computer Science and Economics from Carnegie Mellon University, an M.S. in Information Technology – Software Engineering from Carnegie Mellon University, as well as a Masters in Business Administration from Johns Hopkins University. His approach to personal finance is that of an engineer, breaking down complex subjects into bite-sized easily understood concepts that you can use in your daily life.

One of his favorite tools (here’s my treasure chest of tools,, everything I use) is Personal Capital, which enables him to manage his finances in just 15-minutes each month. They also offer financial planning, such as a Retirement Planning Tool that can tell you if you’re on track to retire when you want. It’s free.

He is also diversifying his investment portfolio by adding a little bit of real estate. But not rental homes, because he doesn’t want a second job, it’s diversified small investments in a few commercial properties and farms in Illinois, Louisiana, and California through AcreTrader.

Recently, he’s invested in a few pieces of art on Masterworks too.

Opinions expressed here are the author’s alone, not those of any bank or financial institution. This content has not been reviewed, approved or otherwise endorsed by any of these entities.